Time-frequency co-movements between commodities and global economic policy uncertainty

Article -

Arouxet, M.B., Bariviera, A. F., Pastor, V. E., & Vampa, V. (2024): "Time-frequency co-movements between commodities and global economic policy uncertainty across different crises", Heliyon

This study explores how economic uncertainty, driven by factors like political and health crises, influences various commodity prices.

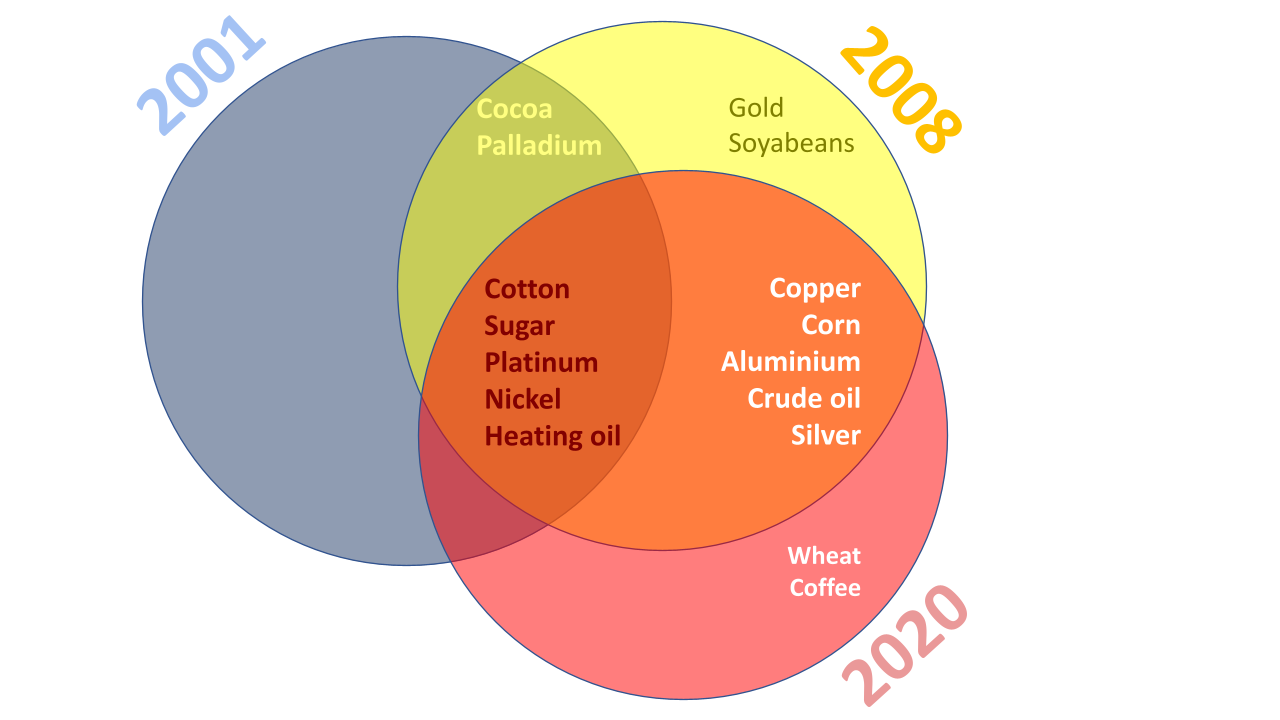

Commodities, like metals, food, and energy, are becoming increasingly popular investments due to their low correlation with other assets, offering diversification benefits for portfolios. This research is unique because it examines a broad range of commodities (precious metals, food, etc.) across a long time period (1997-2022), encompassing major crises.

The study uses advanced techniques to analyze these relationships in detail. It goes beyond traditional methods by employing a tool called "wavelet analysis" to uncover how these connections change over time and across different frequencies. This provides a richer understanding of how commodity prices move together and how quickly they react to uncertainty.

The findings show that not all commodities react the same way to crises. For instance, the global financial crisis and COVID-19 pandemic led to stronger connections between many commodities. This highlights the importance of considering individual commodity dynamics within the broader asset class.

This research offers valuable insights for policymakers, investors, and fund managers by revealing how economic uncertainty impacts specific commodities. The methodology used can also be applied to analyze other financial relationships, even when dealing with complex data.